COVID-19 has impacted nearly every aspect of the local and global economy. This page was compiled of internal and external sources to provide insight about the pandemic as well as its impact on capital markets, rent collection, construction and architecture, operations, public policy, among other impacts.

Rent Collections

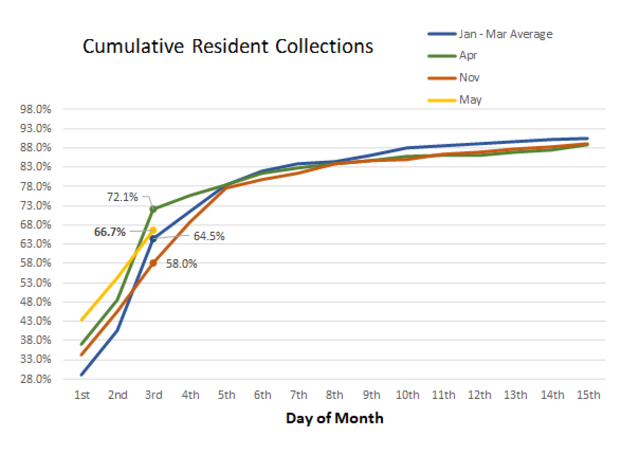

Dominium Rent Collection Report: Through May 3, 2020 we have collected 56% of charges for the month. This is down by (17%) when compared to April collections for the same date and down (4%) compared to the average of January - March collections. It is up 6% compared to November of 2019, the last month in which the 1st fell on a Friday.

Resident collections are higher for 43 properties, but lower for 164 properties. Total resident receipts are at 66.7%, which is down (5%) compared to April, up 2% compared to the January-March average, and up 9% compared to November of 2019.

Subsidy receipts are down (52%) compared to April collections by the 3rd but only down (3%) when compared to November of 2019.

Senior properties are 67% collected (down (21%) compared to April) whereas family collections are 54% collected (down (16%) compared to April).

Previous Dominium Rent Reports can be found below in communications.

Dominium has been collecting information on April Rent Collections from others, which is summarized in the two charts here.

A survey of residents asking about their ability to pay was conducted by J Turner Research in the week of April 20 which received over 2,000 responses across the country. J Turner were able to ascertain information that will be helpful to owners and management companies in laying the groundwork for rental expectations for May.

Kingsley polled 25,000 renters living at multifamily properties regarding their sentiments concerning their ability to pay rent and their future rental plans. The report also offers insights to help real estate professionals meet residents’ needs and minimize the financial impact of the crisis.

Housing & Employment News

Apartment leasing continues despite the pandemic. Dominium’s tracking of move-ins, move-outs, applications and showings shows a trend that indicates the importance of housing. Not surprisingly, move-ins outpaced move-outs in May.

Applications have increased over the past 2 months with a 10% increase in April over March. Note: applications activity can be skewed by available units at any given time.

Not surprising, showings decreased significantly, despite the increase in applications. The ratio of showings to applications in 2019 was approximately 1:1. In 2020, this has shifted to 3:7 in April, with applications outpacing showings by 133%. Although showings remain low due to social distancing concerns, applications and move-ins have continued to increase.

On March 24th, Freddie Mac implemented a forbearance relief plan in response to the COVID-19 pandemic that allows qualifying multifamily borrowers to defer up to three months of mortgage payments. They released a report that provides an overview of this program as of April 13.

Florida Housing Finance Corporation has instituted a rule which provides that owners or developers of affordable housing that suspend any rent increases during the COVID-19 Public Health Emergency will receive preferences in future funding solicitations issued by the Corporation.

Marcus and Millichap’s special report on Commercial Construction details the slowdown in new construction and value-add and redevelopment across the country, and its potential implications for real estate developers’ strategies going forward.

COVID Feedback from the Brokerage Community

The following are a synopsis of conversations Dominium had with brokers over the past week:

- Multifamily sales have stalled. Only four multifamily sales occurred in April in South Florida. This is the lowest sale monthly volume in over ten years. First quarter overall multifamily sales totaled $209 million - 26% from Q1 2019. Second quarter sales will likely be among the lowest on record. The exceptions are deals that were already in progress pre-COVID and time-sensitive deals, such as 1031 exchanges, although new guidance has been released by the government for the latter. Properties that were listed for sale have largely been pulled from the market.

- Collections are strong. Collections have outperformed expectations in March and April. Operators are working with tenants on payment plans, waiving late fees, accepting credit card payments and security deposit conversions. The number one priority for operators—after resident and employee safety and well-being—is retaining tenants and preserving cashflow.

- Finding the Floor. Owners and investors are looking at collections to help find the floor in operations/NOI. Once the worst month for collections is realized, sale conditions are expected to improve. If May collections are similar to April and people start returning to work in May then the collection floor will be short-term. If the shutdown continues for longer, then it’s realistic to assume collections will lower and it’s a longer road to stabilization. Federal support is helping buoy rent payments and occupancy, but a drop off could occur when those programs roll off.

- Private Capital will lead the recovery. In the last downturn, private capital buyers were the first to start buying multifamily properties. I expect this will happen again this time around. Many private capital buyers are ready to enter the market on “finding the collection floor”. Dry powder is at record levels; in other words, there is tons of cash on the sidelines.

- Returns. Encouragingly, investor returns remain in line with pre COVID expectations. Any pricing readjustment is likely attributable to a lower NOI from collections and not from a change in cap rate or IRR. Properties with strong collections will not see any meaningful pricing changes.

- Debt. Debt markets are beginning to stabilize. Fannie Mae, Freddie Mac and certain local banks are the primary lender source for private capital investors. The time needed to achieve financing is longer due additional workloads being assigned to lenders as part of the government stabilization programs. Loans are being priced around 65% LTV between 3.7-4.2% with 6-12 months of reserves.

- Cap rates should not be changed for Covid-19, as it is a temporary situation. Changing cap rates incorrectly makes Covid-19 a permanent change instead of a temporary problem. Instead, Covid-19 affects rental rates / occupancy / delinquency for the short term. After the Covid-19 term, rental collections and therefore valuations return to “normal” defined as what they are before Covid-19.

- Duration. To determine the length of the Covid-19 financial impact, lenders / Institutions have asked for this language – “Our conclusions are consistent with the expectation of market participants.”

Last Month, Florida Housing surveyed last all affordable housing in Florida on rental data (collections, vacancy, delinquency and respondents’ expectations), in a poll conducted by Robert Von, president of Meridian Appraisal Group. His analysis of the data is summarized here:

- Rent Collections. Covid-19 will be a problem for 6 months and rental collections will decline, after which it will take 6 months for rental collections to grow and to get back to stability / “normal” / pre Covid-19.

- Appraisals. Value is based on current, pre-Covid-19 NOI / rental collections. Cap rate is based on latest market data / pre-Covid-19. There will be a cash loss for rental decline over the next 12 months that will decrease value somewhat.

- Rental market studies. Stabilized rental rates are determined after Covid-19 and are therefore not reduced by Covid-19. So new construction that starts rental in 18 months is not affected. Projects that start leasing during the 1 year Covid-19 term still have their stabilized rental rates determined post Covid-19, but the project will have a one-time cash loss in rental collections for the time they are renting during Covid-19.

Pandemic News

The CDC’s tracker of confirmed cases of and deaths from COVID-19 across the US provides the most up to date information on the spread of the virus.

IHME’s COVID-19 Projections page shows trends and projections of deaths and hospital resource usage. The graph below shows their projection for hospital resource use:

Scientists to Stop Covid-19, a group of scientists and physicians, offer four proposals to produce safe and effective therapeutics and vaccines in the shortest possible timeframe, and to reopen our society in a manner that reduces the risk of future COVID-19 outbreaks.

Minnesota has begun a process of reopening businesses according to various factors, including interaction with customers and predictability. Governor Tim Walz likened the process to a position on a dial.

During “The Science Behind COVID-19 Mathematical Models” experts share different perspectives of COVID-19 models, and how different modelers arrive at them. This webinar includes a discussion of the differences between mathematical and statistical models and why they might be generating different projections, as well as how they can be used for policy and planning purposes.

By Friday, more than a dozen states will have begun to reopen their economies and public life, according to the New York Times, even though health experts have expressed concern that a premature opening could lead to a spike in coronavirus infections that would not be detected in official case counts for weeks.

Economic News

The American economy continues to stagger under the weight of the coronavirus pandemic, with another 3.8 million workers filing for unemployment benefits last week, bringing the number of workers joining the official jobless ranks in the last six weeks to more than 30 million.

With airlines around the world reeling from the impact of the coronavirus outbreak, attention remains focused on when the industry will recover and how long that recovery will take. According to global travel specialists Atmosphere Research Group, that recovery timeline will slowly stretch out for two full years after COVID-19 is declared as being "under control".

Bloomberg reports that the coronavirus lockdown will cause the biggest drop in energy demand in history, with only renewables managing to increase output through the crisis.

Treasury & Risk discusses deflation that is following the COVID-19 pandemic that shutdown large portions of the global economy. In doing so, it examines the history of and the precondition for deflation.

Other Interesting & Helpful Resources

NMHC has a map outlining state and city essential businesses, stay-at-home orders, exempt housing construction, and which areas are allowing residential construction projects to continue.

McKinsey & Company created a Global health and crisis response document with scenarios and paths forward, how to plan and manage responses to the virus, and sector-specific impacts. The comprehensive document includes data from WHO, Johns Hopkins University, the CDC, Forbes, NPR, and other international government publications to produce this analysis.

State-by-State Actions

- Schools: Education Week

- Stay at Home/Shelter in Place: The New York Times

- Construction Limits: Architect Magazine

Resident Resources

Freddie Mac offers a Renter Helpline, which provides counseling for renters on budgeting, credit improvement and debt management. The attached flyer is available in multiple languages.

HUD has put together a guide and FAQ for Renters during the Pandemic.

IRS Information on COVID-19 Checks

Dominium Resident Resources by property

Information on filing for unemployment

Communications

We hope that our friends and partners in affordable housing find this information helpful and will send other information our way as well. A collection of all previous updates can be found below:

April 1, 2020 - Impact Update #1

April 2, 2020 - Impact Update #2

April 3, 2020 - Impact Update #3

April 4, 2020 - Impact Update #4

April 6, 2020 - Impact Update #5

April 7, 2020 - Impact Update #6

April 8, 2020 - Impact Update #7

April 9, 2020 - Impact Update #8

April 10, 2020 - Impact Update #9

April 14, 2020 - Impact Update #10

April 21, 2020 - Impact Update #11

April 28, 2020 - Impact Update #12

![]()